CPV®

Asset Management

More Owners of North American Merchant Power Generation Assets Have Entrusted Their Plants to CPV Asset Management Group Than to Any Other Company

Interested in cpv’s asset management services?

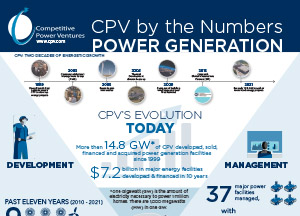

With more than 9,300 MW actively under management and more than 10,000 MW successfully sold or transitioned since 2001, we understand the value of assets, from the earliest development stage through mature operation. We also understand project assets require different services at different times. By deploying multi-disciplinary teams and the latest power generation technologies, we manage to seek out and harvest value from every area of the asset.

CPV innovates through our collaboration with GE Digital to develop and launch new technologies that create efficiencies and cost savings at plants we own and manage.

OUR SERVICES

Corporate

- Strategy development & execution

- Manage all Project Contracts

Operations Management

- Availability & reliability improvement

- Oversee 3rd-party Operations & Maintenance provider

- Budgeting & Cost Control

Environmental

- Manage new permit applications or permit modifications

- Oversee existing compliance systems

Regulatory

- Influence & monitor competitive markets

Gross Margin Management

- Origination & structuring of PPA’s, hedges and capacity transactions

- Development & execution of Risk Management Policy

- Gross margin forecasting & benchmarking

- Enhancing capacity revenues through auctions & bilateral transactions

- Optimizing daily dispatch

- Oversight of 3rd-party energy trader

- Power and fuel contract management

- Collateral management

Finance & Accounting

- Lead refinancing and M&A transactions

- Maintain facility G/L and prepare F/S

- Financing covenant compliance

Treasury Management

- Daily cash management

- Interest rate hedging

- Counterparty risk management

Other

- Dispute Resolution

- Capital project & construction management

THE AMG APPROACH

[wpgmza id=”12″]